By Srinivas Chowdary Sunkara // petrobazaar // 15th May 2020.

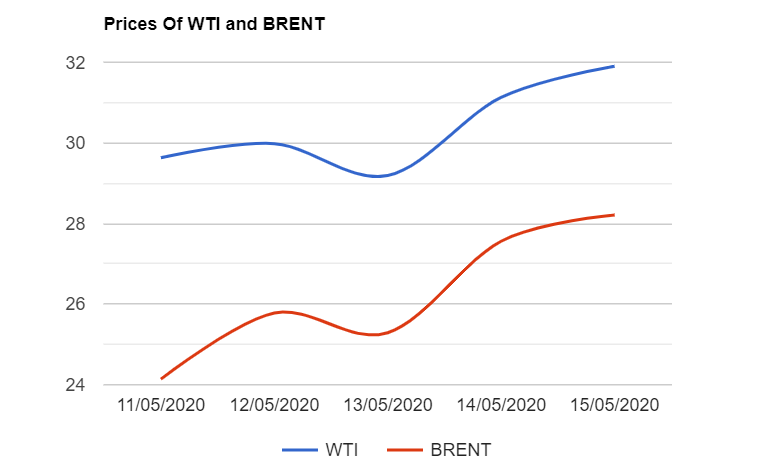

Brent oil futures for July delivery closed at $31.3 after an increase of $1.94 or 6.65% on London based ICE Futures Europe exchange and WTI oil futures to be delivered in June rose $2.27 or 8.98% to settle at $27.56 a barrel on NYMEX last night. In Shanghai, crude oil main contract futures rose 12.5 Yuan or 5.06% to close at 259.5 Yuan/barrel while MCX crude oil May futures advanced Rs.164 to Rs.2058 a barrel yesterday. WTI traded at a discount of $3.57 over Brent during yesterday's session.

The world crude oil benchmark crude futures indexes showed upward evolution today extending yesterday's gains after a report showed picking up demand in China after the easing of curbs to stem the coronavirus outbreak. Weekly report showed that U.S crude inventories fell for the first time in 15 weeks. U.S production numbers reduced by 300Kbpd at 11.6Mbpd. Cushing stocks are drained by 3Mb during the last week that provided some support to oil futures. IEA report said that the crude inventories to fall by about 5.5 Mbpd in the second half of this year. Turning to WTI futures, front month June contract still has 138 Mb due for delivery with another four sessions before expiry. WTI short sellers are the ones under pressure ahead of June contract expiry, with prices climbing and trading towards the top of the range since the contract became the front month. Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com