By Srinivas Chowdary Sunkara // petrobazaar // 14th May, 2019.

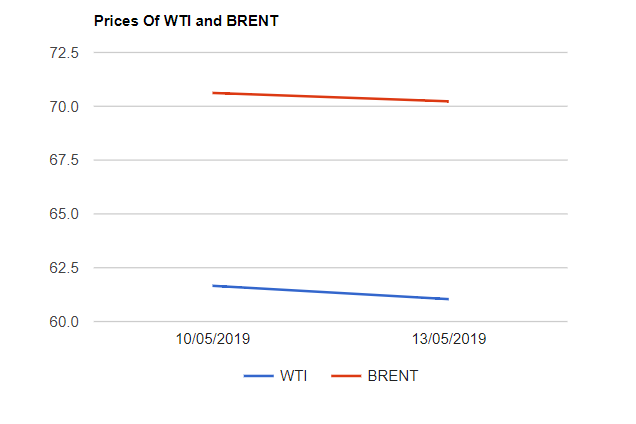

Brent prices were dipped by 39 cents to $70.23 and WTI prices settled 62 cents down at $61.04 a barrel last night. Shanghai crude oil main contract rose by 11.3 Yuan or 2.33% to 496.8 Yuan/ barrel while MCX crude futures closed Rs.14 down at Rs.4312 yesterday.

The global futures traded higher in the early trade after Saudi announced that the two of its oil tankers were among the vessels attacked off the coast of the UAE. Later on, Oil markets were pressed by a slump in equity markets as the investors got spooked by the escalation of trade war irritants between two largest global markets. It is to be noted that the oil prices increased when equity markets slumped above 2%, so the macro economic downdrafts have caught up with the geopolitical updrafts.

Monthly oil market reports are due this week and ever trusted API will report later today. As per the analysts, Oil prices may climb by 1% or above, If uncertainty persists. Today, Asian markets opened up and trading in green at the time of writing. Have a good day.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com