By Srinivas Chowdary Sunkara // petrobazaar // 12th August, 2020.

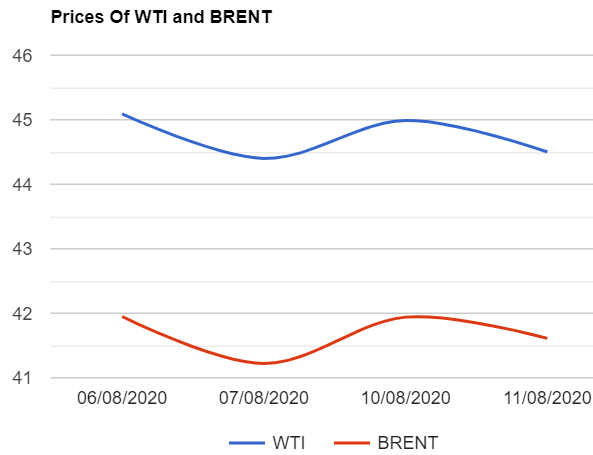

Brent oil futures price for Oct delivery went down 49 cents or 1.09% to settle at $44.5 a barrel on London based ICE futures Europe exchange and WTI oil futures to be delivered in Sep edged down 33 cents or .79% to close at $41.61 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures rose by 2.9 Yuan or .99% to close at 294.9 Yuan/barrel while MCX crude current month contract prices dipped Rs.38 to settle at Rs.3121 a barrel yesterday. Brent premium over WTI narrowed down to $2.89 during the session.

The world crude oil price indexes moved flat most of the time yesterday after demonstrating an upside momentum during the Asian hours. Surge in infection cases, Dimmed hopes on U.S stimulus package weighed on oil prices. Profit booking following the API numbers also pushed oil prices down. Although KSA OSP announcement was bullish for the market, The Chinese floating storage situation seems to be the single biggest near-term headwind for the oil market.

Turning to weekly data, API predicted 4.4Mb draw in crude stocks last week, more than estimated. Gasoline stock piles declined by 1.3Mb while distillates were down by 2.9Mb. EIA will confirm the numbers later today. Consensus is on draws. EIA STEO was out yesterday. As per the report, EIA raised its 2020 forecasts for WTI price by 2.5% to $38.50 and up its Brent price by 2.3% to $41.42 from the July forecast. EIA also estimated U.S domestic oil production to an average 11.26 Mbpd this year, down 3.2% from the previous view.

Today morning, Asian markets opened flat since markets already priced in U.S stock draws. Analysts say that near term strong follow-through is not seen. Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com