By Srinivas Chowdary Sunkara // petrobazaar // 12th March, 2021.

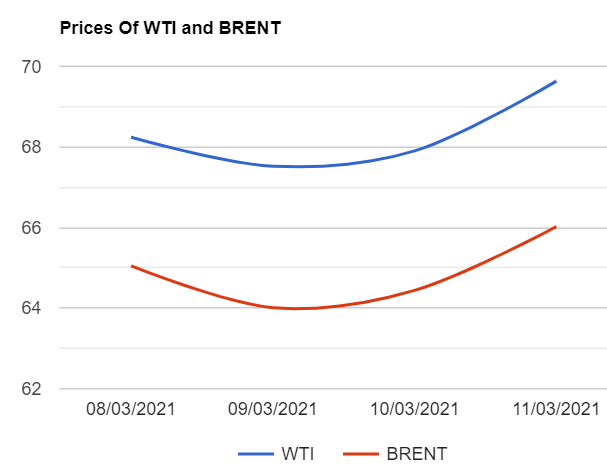

Brent oil futures for May delivery advanced $1.73 or 2.55% to settle at $69.63 a barrel on London based ICE futures Europe exchange. In U.S, WTI oil futures to be delivered in April rose $1.58 or 2.45 pct to close at $66.02 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices went up 4.4Yuan to 421.7Yuan/bbl while MCX crude oil current month futures prices traded Rs.141 up to Rs.4796 a barrel yesterday. Brent premium over WTI widened to $3.61 a barrel during the session.

The world crude oil price index curves continued to swing upward on expectation of vaccines rollout will bolstered economic outlook. Drawings in U.S product stocks outweighed slid in crude stocks that supported oil complex. Refineries are expected to increase processing to stabilize product stocks in the second and third quarters. The prospective rise in refinery's throughput will draw down crude stocks, that has been boosting futures prices and causing calender spreads to tighten. Turning to supply side, OPEC+ leaders are skeptical on demand outlook that pushed them to opt cuts roll over during March 4th meeting. On the contrary, It is evident that, even if consumption remains at current levels, Global inventories will continue to tighten over the next six months and any relaxation over corona control will intensify draw down that will again push oil price up. I think producers need to increase the production to protect oil market share in the energy sector in the second and third quarters. Oil futures prices opened in red during Asian hours today. Rig numbers are due later today.

Good day and happy week end to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com