By Srinivas Chowdary Sunkara // petrobazaar // 8th Nov, 2018.

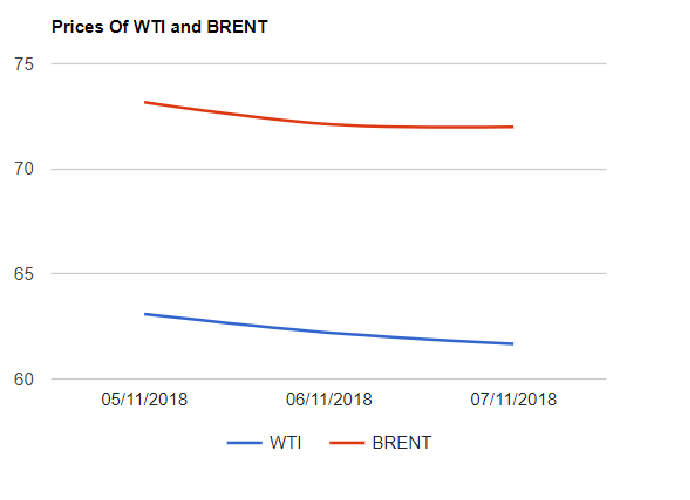

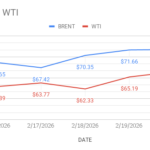

Last night, Brent lost 13 cents to $72 and U.S crude slipped to $61.67 after losing 54 cents. Oil markets are trading in a bearish territory, but not out of woods yet. On Wednesday, Markets opened in green on production cut talks, later on, Followed the bearish stock reports which weighed on the oil prices. EIA reported another build in U.S crude stocks and record high production last week. Now U.S, Saudi and Russia broke through 33 Mbpd for the first time in Oct, signalling that these three countries alone can meet one third of global consumption.

Iran sanctions are in effect, 180 days waivers were granted to 8 importing countries. U.S elections are over and OPEC felt the trump pressure on pricing and now markets will start to hear public comments from week end meeting on pulling back from the recent production boost. Short term mood remains negative until and unless markets proves that it can hold on to rally. Today Asian markets are opened mix. Good day.

Disclaimer: Views and opinions expressed here are for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com