By Srinivas Chowdary Sunkara // petrobazaar // 8th Sep, 2020.

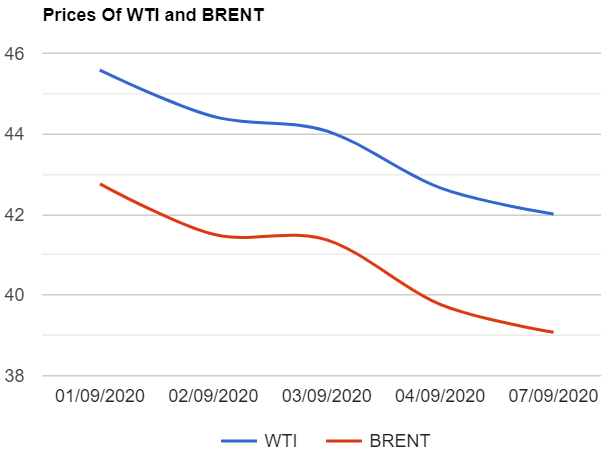

Brent oil futures prices for Oct delivery slipped 65 cents or 1.52% to $42.01 a barrel on London based ICE futures Europe exchange and WTI oil futures for Oct delivery skidded 69 cents or 1.73 pct to close at $39.08 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices dived 11.9 Yuan or 4.18% to 272.5 Yuan/barrel while MCX crude oil Sep futures settled Rs.12 down at Rs.2891 a barrel yesterday. Brent premium over WTI widened marginally to $2.93 a barrel during the session.

The world crude oil price indices continued to demonstrate downward momentum this week, extending last week's losses. A brief tug-of war was evident between bargain-hunting buyers and traders continuing to sell down following the KSA made the deepest monthly price cuts for supplies to Asia in five months. Demand worries and inventory build up consent continue to lingering around the market since the market became skeptical after OPEC+ talk of easing supply cuts. U.S drillers adding rig numbers for the second week also pressed oil complex. Turning to global supply news, Phone conversation news between KSA and Russia roaming around which says that both the spearheads are satisfied with the compliance rate while Novak said that laggards request over extension period for compensation for over production will be addressed in the next meet.

On the technical front, John Kemp is in the opinion that the anticipated re balancing of the oil market has stalled for the time being, which has encouraged some funds to switch from a bullish to a more neutral stance or even start building outright short positions. As per his report, Hedge funds have boosted their short positions in crude and fuels to the highest levels for 19 weeks, since April 21. However Hedge funds selling in Brent, middle distillates revealed a clear bearish turn in sentiment. Port folio managers were the heavy sellers of Brent, U.S diesel, European gas oil and U.S gas oil in the week to Sep 1st. Turning to data, API numbers are awaited later today while IEA and OPEC monthly numbers are expected during the week. Today, Asian markets opened in negative territory, extending yesterday's loss. I expect markets will move sideways.

Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com