By Srinivas Chowdary Sunkara // petrobazaar // 8th June, 2022.

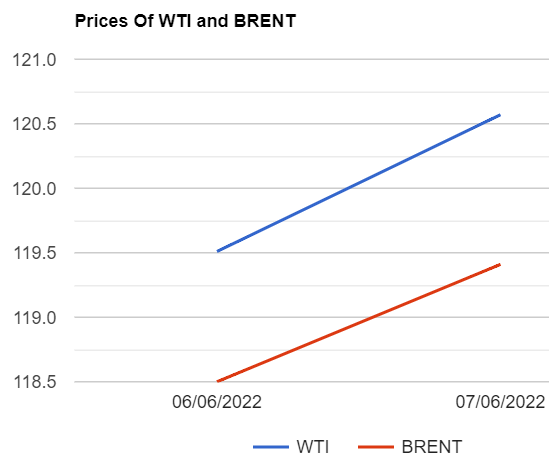

Brent oil futures for August delivery rose $1.06 or 0.89 pct to close at $120.57 a barrel on London based ICE futures Europe exchange while WTI oil July futures prices traded 91 cents high to close at $119.41 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices went up 3.7 Yuan to 753.9 Yuan/bbl where as MCX crude oil front month futures prices settled Rs.44 down to Rs.9181 a barrel yesterday. Brent traded at a premium of $1.16 a barrel over WTI during the session.

The world crude oil price index curves continued to hover up after both the benchmark futures traded up amid bullish sentiment across the market. Demand recovery from Shanghai after two months of covid restrictions and tightening supplies amid doubts over OPEC+ group meeting over targeted increases are the fundamental factors that supported oil complex. Expectation of low U.S inventories also boosted oil prices up. API showed build in crude and product stocks in U.S last week. EIA numbers are due later today. Consensus is on draws. Bull market with huge refining margins accelerating crude oil prices and spreads. Trafigura's CEO expects oil prices to touch $150 a barrel or may touch even higher this year. Goldman sachs predicted that Brent price to reach $135 a barrel for the period between the second half of 2022 and the first half of next year. Today, Asian markets opened in green and oil prices advanced on prevailed existing bullish factors, Adding to previous session gains.

Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com