By Srinivas Chowdary Sunkara // petrobazaar // 5th Nov, 2021.

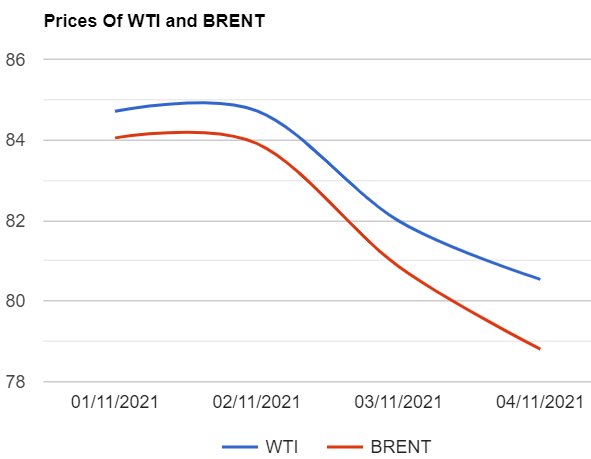

Brent oil futures for Jan delivery traded down $1.45 or 1.77 pct to close at $80.54 a barrel on London based ICE futures Europe exchange. WTI oil Dec futures prices dived $2.05 or 2.54% to settle at $78.81 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices slipped 14.1Yuan to 510.2Yuan/bbl while MCX crude oil front month futures traded Rs.130 or 2.15 pct high at Rs.6171 a barrel yesterday. Brent premium over WTI widened to $1.73 a barrel during the session.

The world crude oil price index curves continued to show downside momentum on OPEC+ decision to continue with agreed numbers of additional 400000 bpd month on month. Bearish weekly numbers continue to weigh on oil complex. EIA confirmed that U.S crude stock numbers are added on 3.3 Mbpd while gasoline stocks were down by 1.5Mbpd where as distillates stocks were built up by 2.2Mbpd during the last week. U.S drillers ramped up domestic production, Marginal increase in crude through put into refineries with unchanged operable capacity are the factors, Contributed to additional barrels last week. On the Supply side, OPEC+ decided not to increase supplies beyond agreed 400000 bpd to ensure market stability. The producers council defended that they took decision on demand and supply numbers. The group still see a demand threat from Delta+ variant and continuing restrictions. The White house said that OPEC+ had the power to put more oil on the market and influence gasoline prices while U.S operated in a system in which oil producing companies made their own decision on supply. Today, Asian markets are opened in green, taking back some of the yesterday's losses. Oil futures are heading towards weekly loss.

Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com