By Srinivas Chowdary Sunkara // petrobazaar // 5th August 2020.

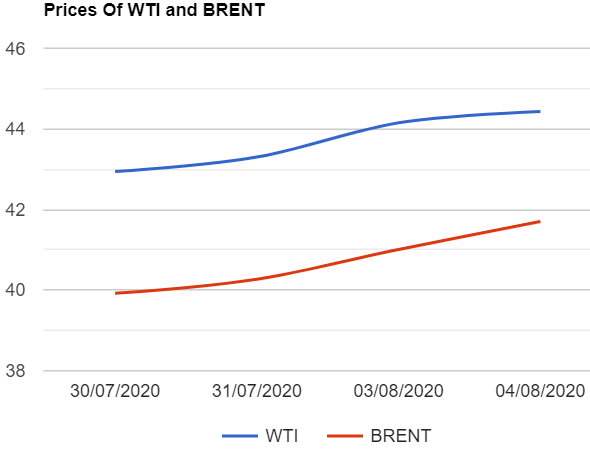

Brent crude oil futures for Oct settlement rose 28 cents or 0.63% to $44.43 on London based ICE futures Europe exchange while U.S crude futures, WTI prices settled 69 cents up at $41.7 a barrel on NYMEX last night. In Shanghai, crude oil main contract futures dropped by 0.6 Yuan or -0.21% to close at 281.3 Yuan/barrel where as MCX crude oil August futures went Rs,48 up to close at Rs.3151 a barrel yesterday. Brent premium over WTI narrowed down to $2.73 during the session from previous session.

The world crude oil benchmark price indexes rose to near five months high yesterday, Set to close at their highest since early March. Both the benchmarks opened down slightly on Tuesday holding in a familiar range around $40 per barrel since the traders feared over resurgence of virus cases may keep lid on demand. Oil prices turned positive on stimulus hopes along with positive manufacturing data from U.S, Europe and Asia. On the supply side, EIA reported that U.S oil production plunged to just 10 Mb/d in May, down from 11.9 mb/d in April. OPEC+ will boost output this month by about 1.5 Mbpd that keep weigh on oil prices. Turning to weekly data, API reported 8.587Mb and 1.749Mb draw in U.S crude and gasoline stocks while Distillates were estimated to be build up by 3.824Mb. I expect today's big draw may support WTI prices.

On the technical front, John Kemp says that hedge fund's confidence is faltering due to new lockdowns and slower recovery in aviation industry. Money managers and Portfolio managers sold the petroleum futures and options contracts during the week ending July 28th as per latest news. Today, Asian markets opened in red with slight correction from yesterday's close. Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com