By Srinivas Chowdary Sunkara // petrobazaar // 2nd Feb, 2022.

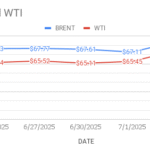

Brent oil prices for April delivery settled 10 cents or 0.11 pct down to $89.16 a barrel on London based ICE futures Europe exchange. WTI oil futures for March delivery closed 5 cents or 0.06 pct up at $88.2 a barrel last night. In Shanghai, Crude oil main contract futures prices remained at 534.5Yuan/bbl while MCX crude oil front month futures prices rose Rs.53 or 0.81% to Rs.6624 a barrel yesterday. Brent premium over WTI narrowed down to $0.96 a barrel during the session.

The world crude oil price index curves moved flat yesterday with a little change in benchmark prices. Both the benchmark prices maintained bullish momentum on expected supply shortage and escalation of political tensions in Middle East and between Eastern Europe and Russia over Ukraine. Analysts expectation of rising U.S crude stocks kept lid on oil prices where as producer's group very likely to go with unchanged supply policy underpinned oil prices yesterday. API report showed draws in U.S crude stocks by 1.6 Mb for the week ended Jan.28th while gasoline stocks were piled up by 5.8Mb, Negating analysts expectations of up in crude stocks. EIA will confirm numbers later today.

Today, Asian markets opened in bullish mood, Adding to previous month's gains on bullish weekly numbers and amid prevailed political tensions. OPEC+ meet outcome may spur some volatility today however markets are expected to maintain bullish momentum as the demand started recovering and physical stocks are keep tightening.

Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com