By Srinivas Chowdary Sunkara // petrobazaar // 1st Oct, 2021.

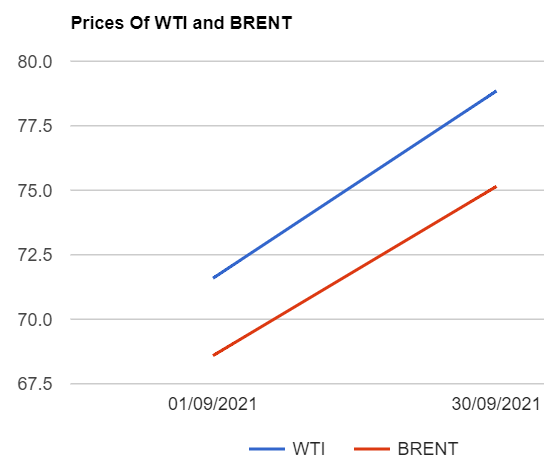

Brent oil futures prices for Nov delivery edged up 21 cents or 0.27 pct to close at $78.85 a barrel on London based ICE futures Europe exchange. WTI oil Nov futures rose 32 cents or 0.43% to settle at $75.15 a barrel on NYMEX last night. Brent Nov futures expired yesterday and most active Dec futures prices closed high. In Shanghai, Crude oil main contract futures prices went up 5.4 Yuan to 494.6Yuan/bbl while MCX crude oil front month futures prices settled up Rs.10 to Rs.5584 a barrel yesterday. Brent premium over WTI narrowed down to $3.7 a barrel during the session.

The world crude oil price index curves moved flat yesterday as the expected supply deficit Shrugged off prevailing bearish factors such as rising U.S inventories and strong dollar. Both the benchmarks clocked monthly gains of above 5 pct. Before the hurricane, Oil prices have fallen for two months on resurgence of virus cases in North America, Europe and Asia on anticipation of softening demand amid postponement of passenger aviation. Hurricane Ida extensive disruption of offshore production in Gulf of Mexico has been the single most important factor that Contributed to surge in oil prices during the month. Though production losses have fallen from a peak 1.75Mbpd to 0.25 – 0.30 Mpd last week, Expected drawings on inventories across the world, Increasing NG prices and power crisis in China are the other factors that boosted oil prices to three years high. Analysts are in the opinion that Oil prices are likely to remain elevated unless and until OPEC+ responds to open spigots and U.S drillers additional supplies. Today, Asian markets are trading in bearish mood at the time of reporting. Both the benchmarks set to close the week higher.

Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com