By Srinivas Chowdary Sunkara // petrobazaar // 1st Oct 2020.

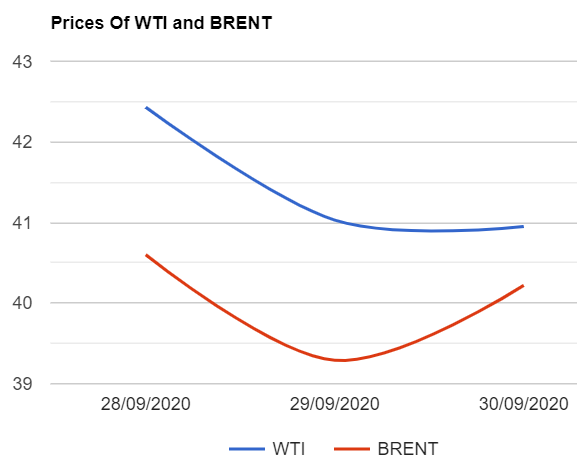

Brent oil futures prices for Nov delivery slipped 8 cents or 0.19% to $40.95 on London based ICE futures Europe exchange and U.S crude futures, WTI prices to be delivered in Nov rose 93 cents or 2.37% to close at $40.22 a barrel on NYMEX. In Shanghai, Crude oil main contract futures prices dropped by 10.8 Yuan or -3.89% to close at 266.6 Yuan/barrel while MCX crude oil current month futures prices climbed Rs.93 to settle at Rs.2937 a barrel yesterday. Brent premium over WTI narrowed down to 73 cents during the session.

The world crude oil benchmark price index curves demonstrated upside momentum yesterday following the weekly report of draws in U.S crude inventories last week. Traders could erase some of the previous session losses. Lingering worries over fading demand amidst increase in virus cases across the globe keep weigh on oil prices. Supply side equation also could not support oil complex since Libya restarted production, which was producing more than 300,000 per day last year. U.S presidential election in Nov, Keeping traders and investors on tenterhooks.

Turning to weekly report, EIA reported crude stocks were drawn by 2Mb while gasoline stocks were built up by 0.7 Mb during the last week. Distillate fuel inventories decreased by 3.2 Mb while refineries trying to blend Jet fuel with other products due to reduced demand. Increase in crude oil refinery inputs and dip in imports might have caused draw down in last week's U.S crude stocks.

Today, Oil markets opened in green during Asian hours and it doesn't demonstrate any firm trend so far. Oil futures prices are moving flat at the time of reporting. Baker Hughes will report U.S rig numbers tomorrow. Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com