By Srinivas Chowdary Sunkara // petrobazaar // 1st Sep, 2021.

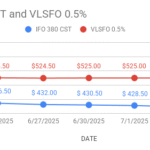

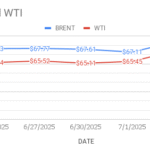

Brent oil futures for Oct delivery slipped 42 cents or 0.57% to $72.99 a barrel on London based ICE futures Europe exchange. WTI oil futures to be delivered in Oct lost 71 cents or 1.03 pct to settle at $68.5 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices rose 2.5 Yuan to close at 440.8Yuan/bbl while MCX crude oil front month contract futures prices settled Rs.48 lower at Rs.5023 a barrel yesterday. Brent premium to WTI widened to $4.49 a barrel during the session.

The World crude oil price index curves turned down yesterday after posting margins in two previous sessions. Both the benchmark prices moved down after API estimate of piling up of gasoline stocks in U.S last week. The prevailing bearish sentiment was further buoyed up by expectation of producers group of opening the spigots by 400k as agreed previously amid U.S appeal for production surge from OPEC+ group to curtail further spike in U.S gasoline prices. Turning to weekly data, API predicted that U.S crude supplies and distillates stocks fell by 4Mbpd and 2Mbpd respectively while gasoline stocks are expected to increase by 2.7Mbpd. EIA will confirm numbers later today and consensus is on draws. Today, Asian markets are opened in green and it does not demonstrate any firm trend so far. All eyes are on Iran barrels back and surprises from OPEC+ meet that may spur some volatility.

Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com