By Srinivas Chowdary Sunkara // petrobazaar // 1st April, 2022.

Brent oil futures prices for May delivery settled $5.54 or 4.88 pct down to $107.91 a barrel on London based ICE futures Europe exchange while WTI oil May futures prices traded $7.54 or 6.99 pct down to close at $100.28 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices went down 15.6 yuan to 675.1 Yuan/bbl where as MCX crude oil front month futures prices slipped Rs.365 or 4.5 pct to Rs.7750 a barrel yesterday. Brent premium over WTI widened to $7.63 a barrel during the session.

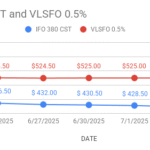

The world crude oil price index curves demonstrated downside momentum after U.S announced the largest ever release from the U.S SPR and called on drillers to boost supplies. The Brent May contract expired yesterday and most active June futures contract closed down to $105.16 a barrel yesterday. Both the benchmarks posted highest quarterly gains since the 2Q20. IEA members set to meet on Friday and expected to announce release of more barrels to offset Russians missing barrels. OPEC+ group agreed to stick to existing agreement and raise May production target by 432,000 bpd. Fears of low demand from China also keep weigh on oil prices. Analysts says that low liquidity in the market, Dwindling open interest and dwindling volumes that is causing outsized moves in prices. Today, Asian markets opened in red, adding more to yesterday's losses. Weekly data from Bakers Hughes is due later today.

Good day and happy week end to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com