crude brent Futures for April delivery inched up 29 cents to $82.69 a barrel while wti oil Futures to be delivered in March edged up 33 cents to $77.11 a barrel on Tuesday during Asian trading hours. Both the benchmarks lost around 1 percent yesterday. Brent traded at a premium of $5.62 a barrel over wti during yesterday’s session.

crude benchmark indices turned down yesterday in a bearish sentiment buoyed up by demand concerns. Ailing Chinese properties sparked demand jitters across markets that caused to reassess the prevailing risk premium from escalation of middle east tensions. Interest rates are in focus aa European policy makers could not come to reach consensus over interst rate hike. On supply front, JMMC virtual meeting is taking place on Feb 1st. Turning to data, API numbers are awaited later today followed by eia confirmations. U.S crude and distillates are expected to reduce while gasoline stocks piled up last week.

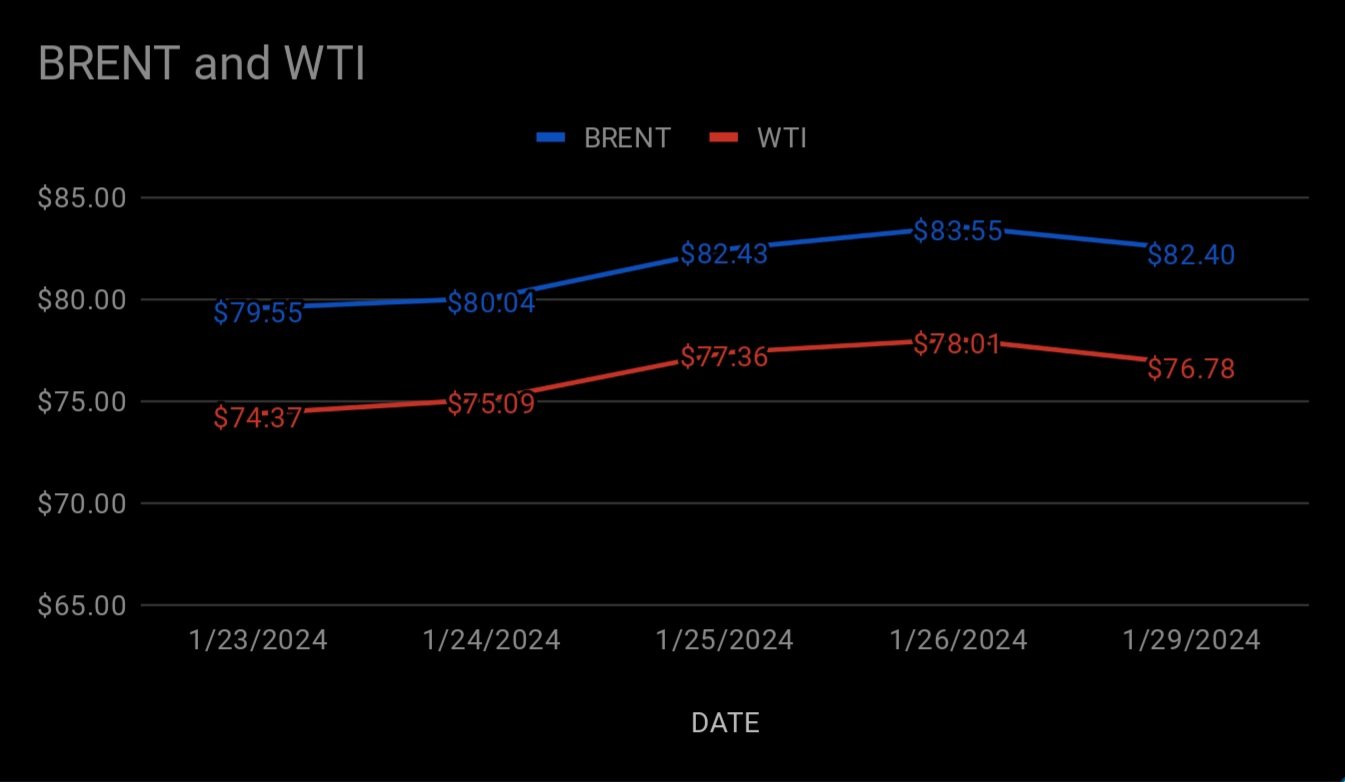

On the technicals side, portfolio managers preferred to exit from brent long positions while short positions are build up marginally for the week ending Jan 23rd. Investors slashed short positions in wti as crude stocks are draining. I see crude markets are range bound this week and profit booking is expected at the end of week.