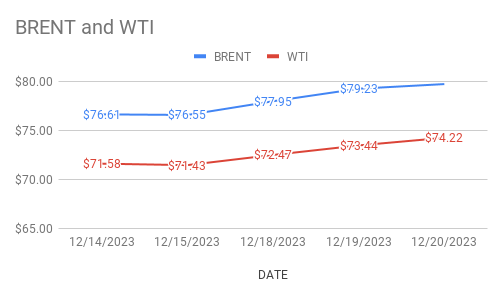

crude brent oil futures for Feb delivery dipped 34 cents to $79.36 a barrel while WTI oil Feb futures prices are moving 39 cents or 0.5% down to $73.83 a barrel on Thursday morning during Asian hours. Both the benchmarks closed up yesterday in bullish sentiment buoyed up by disruptions in red sea. Brent futures premium widened to wti during the session.

crude benchmark indicators turned down today after U.S stocks reported piled up against the analysts expectation. On the other hand, Markets shifted focus from geo-political tensions to supplies factor that kept weigh on crude complex. Turning to weekly data, EIA reported that U.S crude stocks are piled up by 3.5Mbpd while gasoline and distilled stocks are built up by 2.7Mbpd and 1.5mbpd respectively during the last week. Increase in U.S crude production and hike in imports are the factors attributed to be contributed to crude stocks build up. Rig numbers are awaited later today.

Traders seems to prefer profit booking after looking at weekly numbers that demonstrated dent in demand numbers.