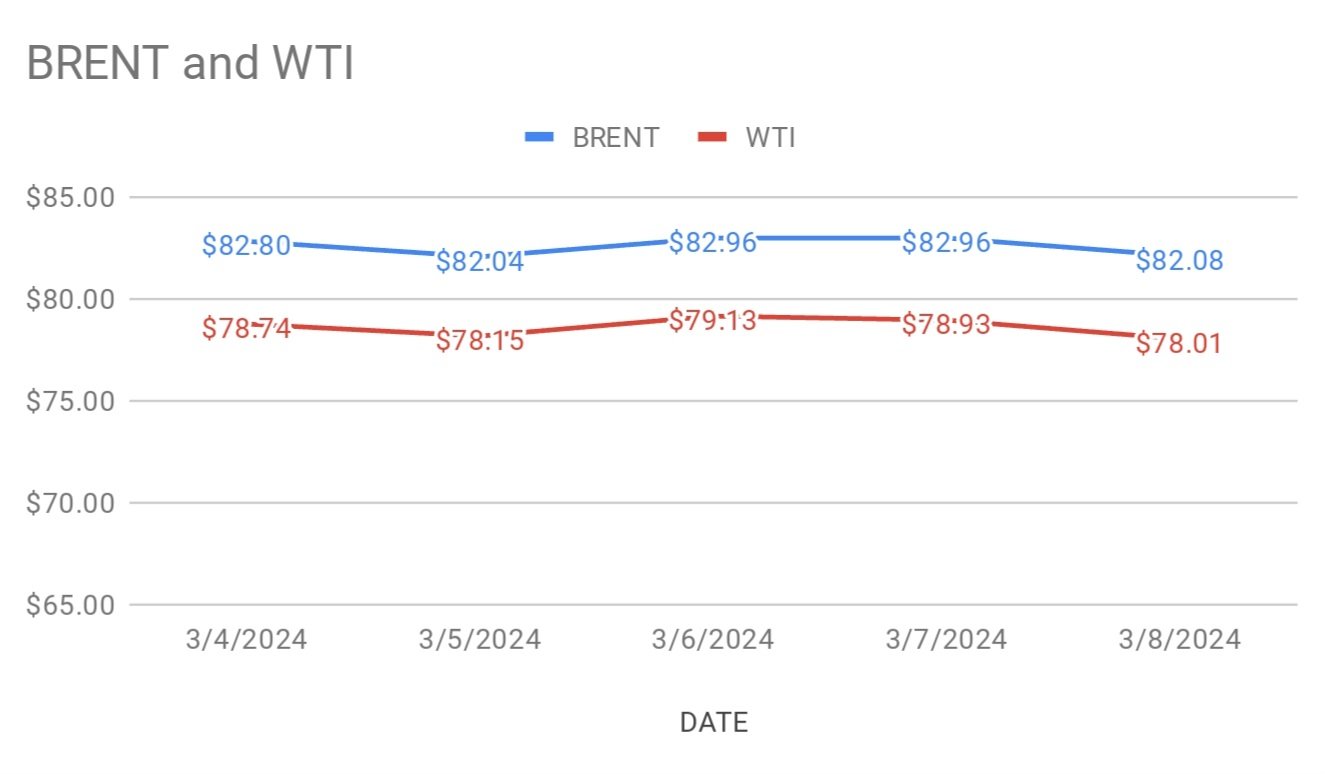

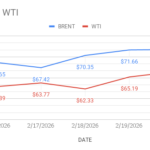

Brent oil Futures prices for May delivery slipped 31 cents to $81.77 a barrel while wti oil Futures prices for April delivery dipped 35 cents to $77.66 a barrel on Monday morning hours in Asia. Both the benchmarks logged in weekly loss on Friday. Brent traded at a premium of $4.07 a barrel during Friday session.

Crude benchmark index curves flattened today after tilted to downside on Friday. The world’s largest no.1 consumer, China’s softening Purchases is the key bearish factor, markets are loooing at. As per the data released last week, Chinese imports rose in the first 2 months of the year, larger, compared to the same period during 2023. These numbers are thinner than preceeding months numbers comparatively. Demand fears outweighed suppliers decision of extending 2mbpd cuts until the end of second quarter. Escalation of geo-political tensions in red-sea waters continue to prevail in the markets. Turning to technicals, portfolio managers reduced their net length In brent Futures while widening in wti Futures and options during the week ending march 5th as per the data from ICE and CFTC. Longs exited the markets while shorts booked profits.