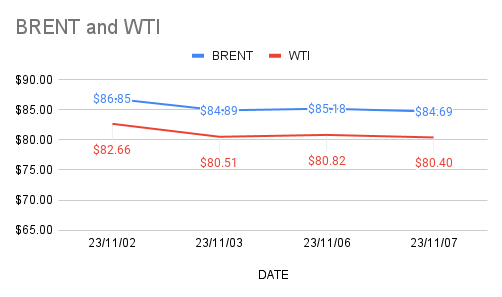

Brent oil futures prices for Jan delivery edged down 45 cents or 0.5% to $84.73 a barrel while WTI oil prices for Dec delivery inched down 37 cents or 0.45% to $80.45 a barrel on Tuesday morning during Asian hours at the time of reporting. Both the benchmarks closed below 0.5% up yesterday. Brent premium over WTI changed a little to $4.45 a barrel during the session.

The crude oil benchmark indicators turned down today after clocked some gains yesterday on bearish sentiment buoyed up by recission fears from Europe compounded prevailing demand fears across the markets. Crude markets gained some support from producer’s announcement of further tightening supplies through out Dec. KSA announced to continue additional 1 Mbpd voluntary cut throughout Dec month. Russia also announced that it would be continue its additional voluntary cuts of 300000 bpd until the end of Dec.

Putting some light on technicals, Investors dumped petroleum futures and options for the second week running on gloomy economic outlook and risk of wider conflict in middle east appeared to be contained. Hedge funds, Money managers and Fund mangers sold petroleum futures and options contracts over the 7 days ending on Oct 31st.

API numbers followed by EIA numbers are awaited. Markets are looking at China’s manufacturing numbers.