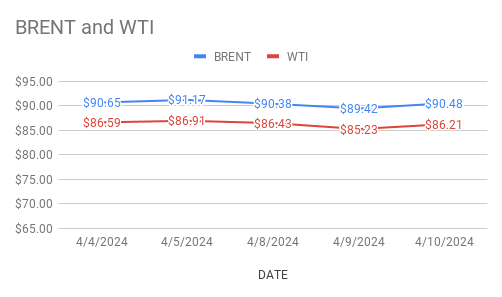

Crude Brent futures prices for June delivery little changed up to $90.58 a barrel while WTI oil May futures prices edged up 7 cents to $86.28 a barrel during Asian hours today at the time of reporting. Both the benchmarks closed above 1 percent up yesterday. Brent premium over WTI widened to $4.27 a barrel during yesterday session.

Crude benchmark index curves demonstrated upside momentum on geo-political tensions in Middle east. Traders are pricing the further escalation of tensions in the middle east as Hamas – Israeli war is expected to involve Iran, world’s third largest oil producer in OPEC. Oil markets remain sensitive to any geo-political news in the market. Prevailed bullish sentiment off-set the rate cut factor as the markets recalibrated their rate expectations to price out a June rate cut. Higher for longer rate could dampen economic growth in turn tame demand outlook. Turning to weekly reports, EIA reported another large build in crude and product inventories. U.S crude stocks rose by 5.8Mbpd while gasoline and distillates stocks went up by 0.7mbpd and 1.7Mbpd respectively during the last week. Increased imports coupled with sank in exports along with unchanged production contributed stock build as per report. Markets are waiting for monthly reports.