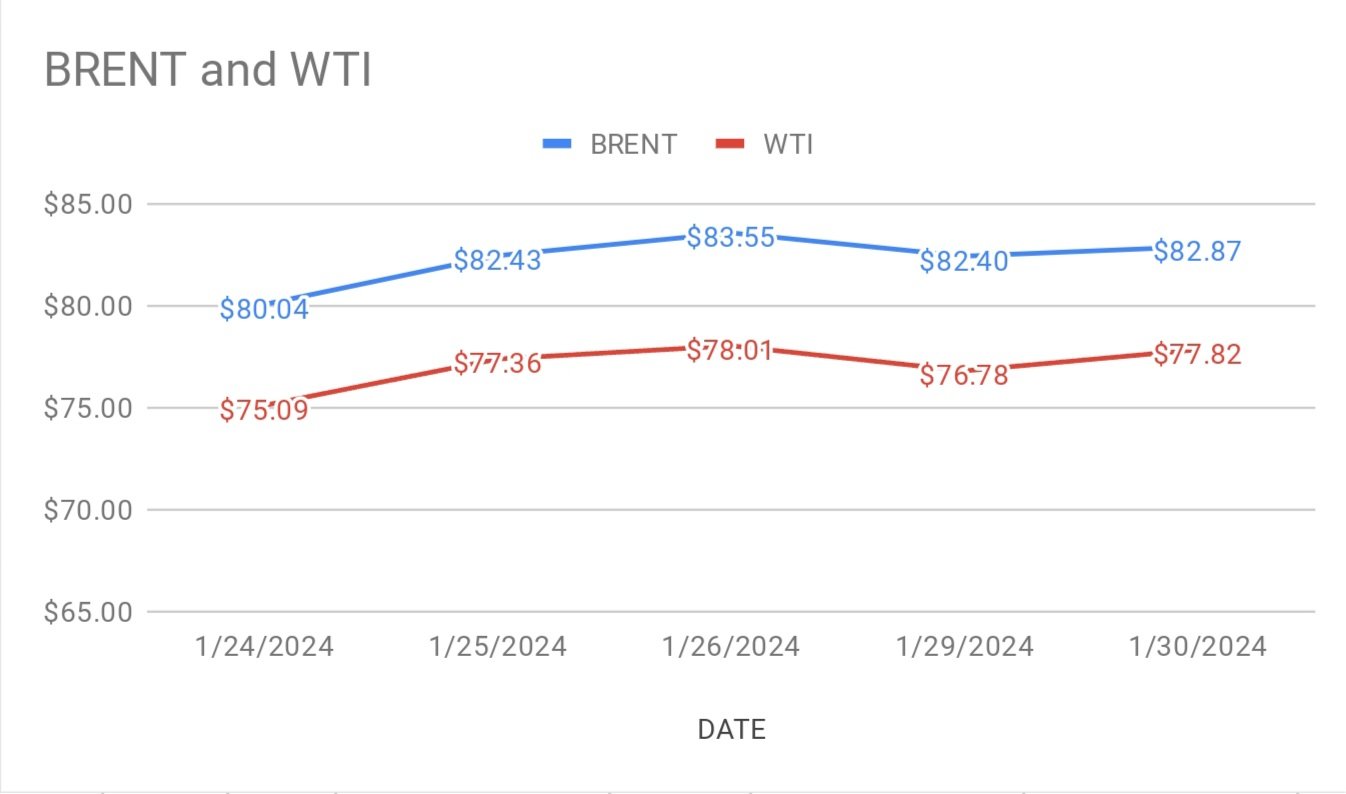

crude brent march Futures settled 0.5 percent up at $82.87 a barrel while wti oil Futures for March delivery rose 1.35 percent to $77.82 a barrel on Tuesday. Brent march contract set to expire on Wednesday. Brent April Futures, the most active contract closed up at $82.50 a barrel on Tuesday. Brent premium over wti widened to $5.05 a barrel during the session.

crude price index curves sloped up on Tuesday after showing downward momentum on the beginning day of the week. Raising global economic growth forecast by IMF fanned positive vibes in the market. Escalation of middle east tensions offset bearish bells from Chinese ailing property that sparked demand concerns. On supply side, KSA is to stick to 12mbpd, no longer to expand to 13mbpd as per official statement. Falling Venezuela output of 6 to 7 lks bpd due to renewed U.S sanctions, Lent support to oil complex. JMMC virtual meeting is scheduled on feb 1st, unlikely to discuss group’s policy for April month, could shed some light on production plans. Turning to weekly data, API announced U.S crude stocks drawn by 2.5 mbpd while gasoline stocks built by 600000 bpd during the last week.

crude markets seems to be pushed up by speculators on building positions after U.S president statement over drone attack. Profit booking is expected at the end of the week.