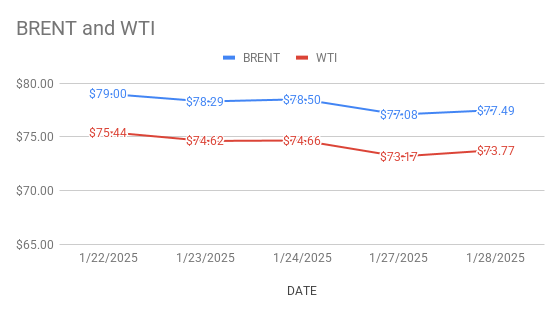

Brent oil March futures prices edged up $1.43 or 2 pct to $77.63 a barrel on London based ICE Futures Europe exchange. U.S crude benchmark, WTI futures for March delivery rose 78 cents or 1 pct to $73.95 a barrel on NYMEX on Wednesday morning during Asian hours. Crude benchmark flat prices rebounded to close up last night.

Crude oil benchmark price index curves demonstrating upward reversal after sharp decline during last couple of sessions. Speculation that Trump administration might target imports from Mexico and Canada, Fears of supply disruptions are prevailing supporting fundamental factors for crude market. On the data side, API weekly bulletin showed piling up U.S crude stocks last week weighed on. EIA confirmations are due later today. Contracted Chinese Jan PMI numbers fanned demand fears across the market. Forecasting warmer than normal U.S temperatures during this week keep lid on heating oil demand. Turning to technicals, Gross short positions in NYMEX WTI contract fell to 30 Million on Jan 21 from 72 Million six week earlier. Falling short positions marked end of short selling cycle that began in August 24.