Crude oil price today as on 15th March, 2025

Crude Oil Flat Price Trends Today

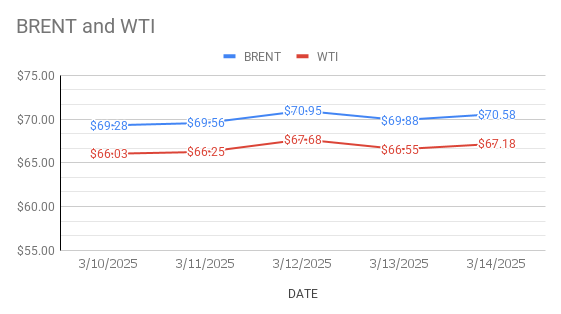

Crude oil Brent futures prices for May delivery settled at $70.58 a barrel while WTI Futures prices for April delivery closed at $67.18 a barrel on Friday. Both the world benchmarks flat futures closed this week with below one percent loss.

Spreads

Time spread, a difference between two futures contracts. Timespreads across all major crude grades were flat to strong with modest backwardation against the claims of creeping fundamental weakness. Brent WTI spread is the difference in Brent crude oil spot price and WTI crude oil spot price. Brent spread over WTI remains flat at $3.4 a barrel during the session.

Crude Oil Price Fundamental Analysis

Oil fundamentals remains largely unchanged this week. Prolonged ceasefire agreement between Russia and Ukraine extends the sanctions on Russian oil. Tariffs, Counter tariffs and broader economic concerns fanned demand worries across the markets. Supply side fundamentals keep weigh on oil complex.

Crude Inventory Data Analysis

Solid draw in product stocks against crude build sent mixed signals to the market this week. IEA monthly data shows that demand estimates are cut for the fourth quarter of 2024 and first quarter of 2025 due to unstable macro economic conditions.

Crude Oil Technical Analysis

Positions numbers showed that Investors largely stayed away from crude markets. Brent net length remains down while longs and shorts reduced positions while WTI net length widened with both longs and shorts dropped from markets

Srinivas Chowdary Sunkara comments on crude oil price movement

Speculators come back to crude markets may trigger some bullish activity in the beginning of next week. Rangebound trades are expected amid uncertainty. Political factors may spur some volatility in the coming week.