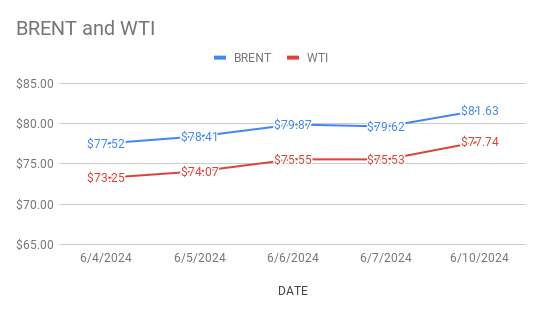

Crude oil price curves are moving flat today. Crude Brent oil futures for August delivery inched down 11 cents or 0.135 pct to $81.52 a barrel on London based ICE Futures Europe exchange. Crude U.S WTI oil futures for July delivery edged down 14 cents or 0.167 pct to $77.61 a barrel today at the time of reporting. Both the benchmarks closed 3 pct up yesterday. Brent premium over WTI narrowed down to $3.89 a barrel during yesterday’s session.

Crude oil price index curves tilted towards the bearish zone today after demonstrating bullish momentum yesterday. Crude markets went up yesterday on hopes of strong demand. The rally was capped today as traders preferred to wait for Key U.S and China CPI data. The outcome of the Federal Reserve’s policy will also paint a clear picture tomorrow. On the technical side, Fund managers preferred to sell oil and gas futures and options last week on a surprise move by the Suppliers group to reduce production. Analysts are in the opinion that a strong conviction is needed for oil markets to recoup from downfall. API weekly data is awaited later today followed by EIA confirmations. Monthly numbers also spur the oil prices during the week.