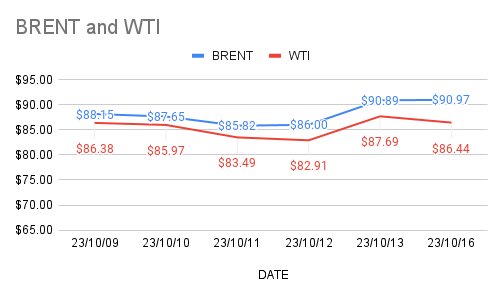

Brent oil futures prices for Dec delivery slipped 22 cents or 0.242 % to $90.67 a barrel while WTI oil Nov futures are trading $1.53 or 1.745 % down to $86.16 a barrel on Monday morning during Asian hours. Both the benchmarks clocked in above 6% weekly gains last week. Brent premium over WTI widened to $3.2 a barrel during Friday’s session.

The world crude benchmark prices spiked around 5 % on Friday after markets priced in the geo-political risk factor. Oil markets are assessing the impact of the Middle East conflict and escalation that involves Tehran. Putting some light on Technicals, Money managers reduced their net length in Brent crude oil futures and options by 65161 contracts to 153174 in the week ending Oct 10th. Longs-only positions fell by 52563 while short-only positions built up by 12598 as per ICE data published. CFTC reported that money managers withdrew 37754 contracts to 268908 during the week ending Oct 10th. Long-only positions were reduced by 36215 while short positions went up by 1539.

Crude markets are not fundamentally supported and it seems to be a speculator game on longs chosen exit route while shorts entry strengthens bearish sentiment.