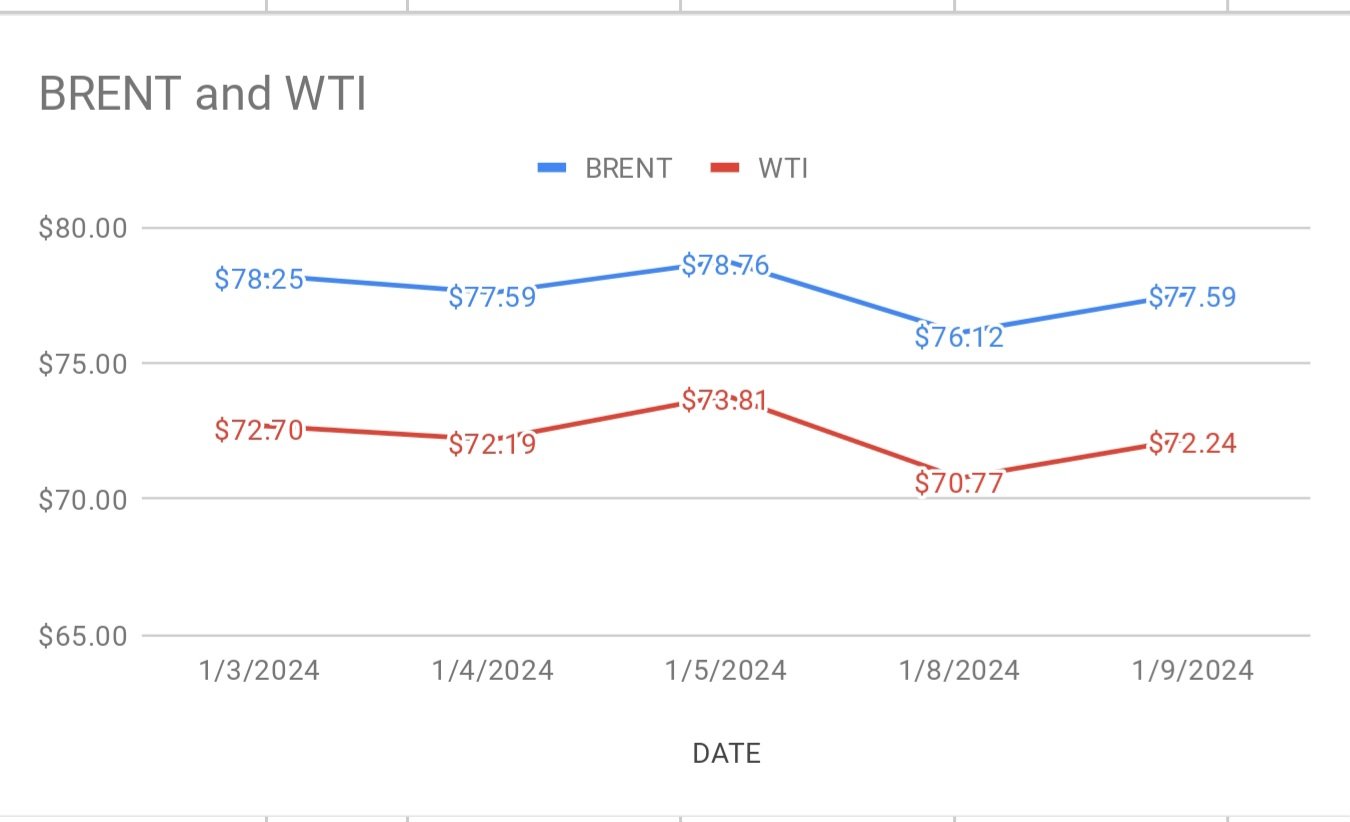

crude brent Futures prices for March delivery rose 28 cents to $77.87 a barrel while wti Feb Futures prices 34 cents to $72.58 a barrel on Tuesday morning during Asian trading hours. Both the world benchmark Futures settled up on Monday offsetting some of previous sessions losses. Brent premium over wti remain unchanged at $5.35 a barrel during earlier session.

crude benchmark curves turned up on bullish sentiment buoyed up by supply side fundamentals. Libya’s closure of sharara oilfield that supplies 3,00,000 barrels per day lent support to crude complex. Russia’s curbing crude oil production in the month of December is another bullish sign existed in the market. Many of the ships are avoiding red sea waters that pushing buyers to dash for the u.s crude, comparative cheaper than brent. On the data side, API predicted that u.s stock fell by 5.2mbpd last week. Eia will confirm the numbers.

Crude markets seems to coming back to bulls territory due to increased positions by speculators. I assume profit booking is awaited at the end of the week. Monthly numbers are awaited that may spur some Volatility in the crude markets.