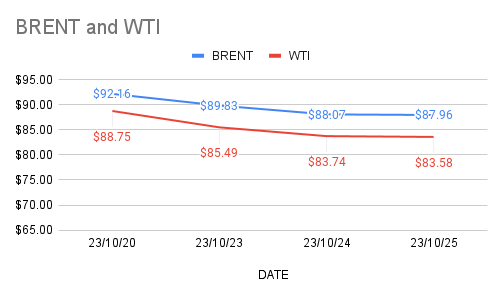

Brent oil futures for Dec delivery moving down to $87.8 a barrel while WTI oil Dec futures are largely unchanged at $83.55 a barrel on Wednesday morning during Asian hours trading. Both the benchmarks clocked losses for last three consecutive sessions. Brent traded at a premium of $4.33 over WTI during yesterday’s session.

The world crude oil price index curves moving flat, Demonstrating downside pressure amid bearish sentiment across the market. A flurry of economic data from Euro zone spilled over demand fears that is keeping oil markets in check. Germany and Britain sketched a bearish picture that could weigh on demand. Widening conflict in the Middle east also fanned concerns in the markets. China’s approval to local governments to issue new debt and falling U.S inventories keep flour to oil complex. On the data front, API estimated that U.S crude stocks are drawn by 2.7Mb while gasoline and distillates inventories dropped by 4.2Mb and 2.3Mb respectively. EIA will confirm numbers later today. Consensus is on fall.

Investors are in weight and watch mode. Longs and Shorts may spur some volatility at the week end. I dont see any significant fundamental factors to drive markets.