By Srinivas Chowdary Sunkara // petrobazaar // 16th July, 2018.

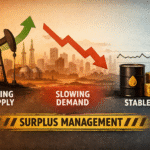

Brent closed up at $75.33, climbed by $0.88 with a 2 pct of weekly loss and WTI climbed by $0.68 a barrel to $71.01, posted a sharp weekly loss of 3.72%. Profit booking on the resumption of Libya's supplies could be seen for last week's tumbling of prices. Shifting of focus on possibility of pumping more oil outweighed the bullish weekly stats and Nigeria workers strike. IEA warning on spare capacity could pacify bulls and extended support to prices.

U.S oil rig numbers remain unchanged. Trump may discuss with Russian counterpart on oil prices in the scheduled meeting this week and Russia indicated for further supply increase of 1Mb, if required. U.S eyed on feeding strategic reserves. I expect this week will be happening week. Have a good day.

Disclaimer: Views and opinions expressed here are for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com