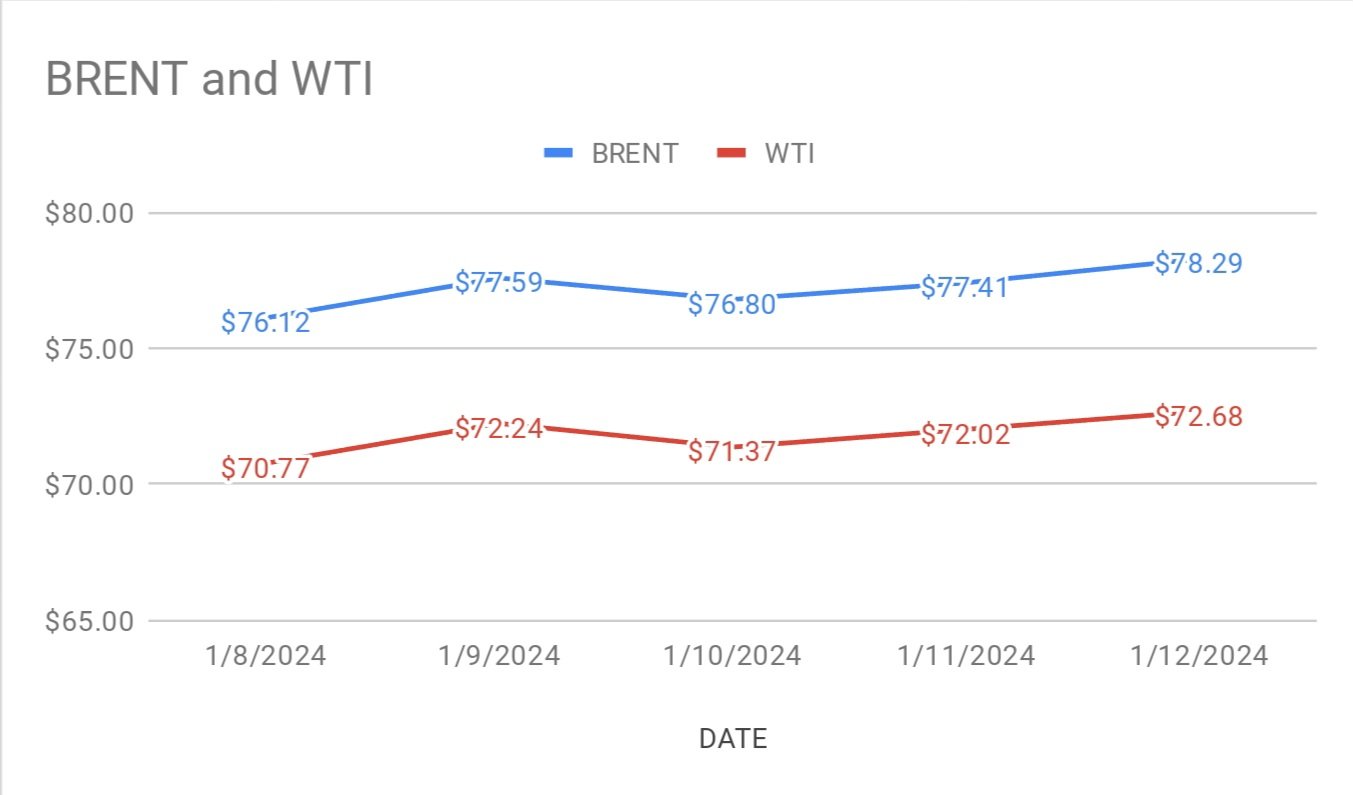

Crude brent Futures for March delivery rose around 1 per cent at $78.29 a barrel while wti oil Feb Futures traded up below 1 percent to $72.68 a barrel on Friday. Brent premium over wti widened to $5.61 during the session.

crude benchmark price index curves demonstrated upside momentum on escalation of red sea waters dispute. Major shipping companies like stena bank, hafnia and torm queued up to restrain their vessels from moving through suez canal. Red sea water covers 15% of world’s shipping traffic. Diversion around south Africa inflate freight charges inturn weigh on economy. World benchmarks closed the week lower. Surge in crude inventories and KSA discounting prices to Asia spurred supply worries in the early week. Front month contract is trading higher than 6 months Futures contract.

On the technicals side, traders boosted positions both in brent and wti Futures to the week ending Jan 9th. Money managers added 38905 contracts to brent Futures and 21798 positions to wti Futures contracts. Longs widened 29942 positions with shorts stretched by 20137 as per ICE and CFTC data released.