By Srinivas Chowdary Sunkara // petrobazaar // 22nd July, 2021.

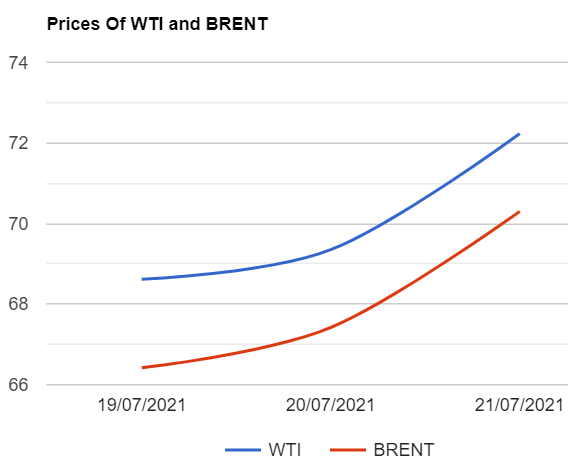

Brent oil futures for Sep delivery rose $2.88 or 4.15% to settle at $72.23 a barrel on London based ICE futures Europe exchange. In U.S, WTI oil Sep futures prices climbed $2.88 or 4.27 pct to close at $70.3 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices inched down 1.4Yuan to 413.1 Yuan//bbl while MCX crude oil current month futures prices remined unchanged due to public holiday in India. Brent premium over WTI was at $1.93 a barrel during the session.

The world crude oil price index curves continued to hover after a drop of 7 pct on Monday due to exacerbated worries over OPEC+ opening the oil spigots and demand destruction concerns amid increase in Delta virus cases in U.S, U.K and Japan. Both the benchmark futures climbed over 4 pct yesterday despite swelling U.S inventories that signed improved risk appetite of the market. Turning to weekly numbers, EIA reported surprise build in U.S crude stocks, Trouncing analysts expectation of stock drawings. U.S crude stocks were piled up by 2.1Mbpd while gasoline and distillates stocks were drawn by 0.1Mb and 1.3Mb respectively during last week as per report. Crude stocks were surprisingly driven by surge in imports and plunge in exports. Crude throughput into refineries due to unchanged operable capacity and dip in percentage utilization also contributed to numbers. Asian markets opened in red, taking back previous session's gains. It doesn't demonstrate any firm trend so far. Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com