By Srinivas Chowdary Sunkara // petrobazaar // 12th June, 2021

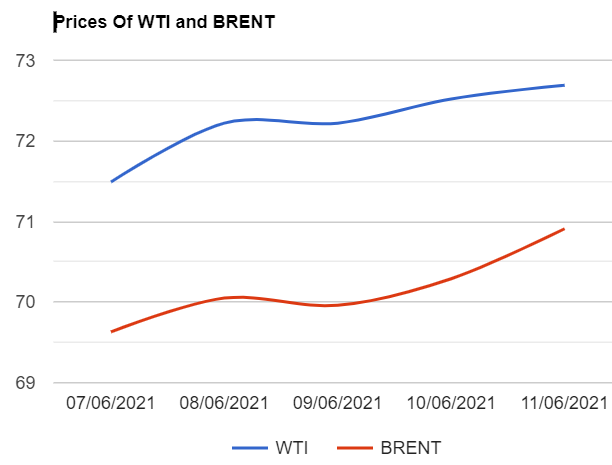

Brent oil futures prices for August delivery surged 17 cents or 0.23 pct to $72.69 a barrel on London based ICE futures Europe exchange. WTI oil July futures prices climbed 62 cents or 0.88% to close at $70.91 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices rose 7.1 Yuan or 1.59pct to 453.5 Yuan/bbl while MCX crude oil front month futures prices jumped Rs.83 to settle at Rs.5208 a barrel yesterday. Brent premium over WTI narrowed down to $1.78 a barrel during the session.

The world crude oil price index curves demonstrated upside momentum on demand rebound from world markets. Both the benchmarks jumped to multi-year's high yesterday on limited apparent progress in negotiations with Iran that signaled chances of excess Iranian barrels come back bleak in near future. Turning to monthly reports, IEA expects global oil demand to rise by 2.5Mbpd m/m in June and further said that OPEC+ group should open the taps to meet the expected growing demand from the world. OPEC reported that total commercial stocks fell by 6.4 Mb in April and the group revised up non-OPEC liquid supplies by 0.1Mb/d from the last month's assessment due to faster than expected recovery in US liquids production in March. On the technical side, Kemp reported that Brent's six-month calender spread has strengthened to a backwardation of around $3.2 per barrel as the traders anticipate that production will remain below consumption, With a further inventory draw down and increasing tightness in the physical markets due to unavailability of physical oil. U.S drillers added another 6 rigs to 365 this week as per Baker Hughes weekly report. Both the benchmarks logged in third weekly straight gains.

Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com