By Srinivas Chowdary Sunkara // petrobazaar // 9th Sep 2020.

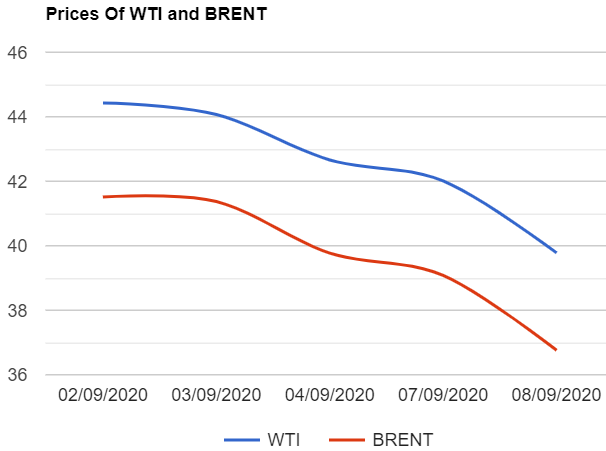

Brent oil futures prices for Oct delivery slumped $2.23 or 5.31% to settle at $39.78 on London based ICE futures Europe exchange and U.S crude futures, WTI to be delivered in Oct dived $2.32 or 5.94% to close at $36.76 a barrel on NYMEX last night. In Shanghai, crude oil main contract futures skidded 9.5 Yuan or 3.4% to close at 269.1 Yuan/barrel while MCX crude oil Sep futures sank Rs.186 or 6.42% to settle at Rs.2713 a barrel yesterday. Brent futures premium over WTI widened to $3.02 a barrel during the session.

The world crude oil futures price indexes moved down steeply yesterday, logged in their lowest levels in nearly 3 months. Stalling demand from Asian countries, The end of U.S driving season and chatter of supplier's indiscipline over supply cut pact are the major fundamental factors that contributed to the trader's skepticism over the oil prices. Lack of fiscal support also pressed oil complex. The widening contango structure combined with easing tanker rates incentivize traders to store the oil. Turning to global supply news, OPEC+ JMMC meeting is scheduled on 17th Sep and it is time for OPEC+ chatter about further deep cuts to stabilize oil prices. On the data side, API estimations are awaited and Analysts expect moderate drawings in U.S stocks. U.S dollar index advanced for the six consecutive session yesterday.

Today, Oil prices opened down during Asian hours, Extending losses from yesterday's slump and It does not demonstrate any firm trend so far. I expect oil indexes move in sideways today. Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com