By Srinivas Chowdary Sunkara // petrobazaar // 4th May, 2021.

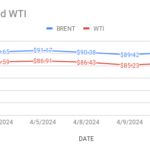

Brent oil futures for July delivery rose 31 cents or 0.46 pct to close at $67.56 a barrel on London based ICE futures Europe exchange. WTI oil June futures closed 91 cents or 1.43 % higher at $64.49 a barrel on NYMEX. In Shanghai, Crude oil main contract futures prices remained at 420.1 Yuan/bbl while MCX crude oil current month futures prices edged up Rs.70 or 1.48 pct at Rs.4786 a barrel yesterday. Brent premium narrowed down to $3.07 a barrel over WTI during the session.

The world crude oil price index curves continued to move up on expected improvement in demand outlook from two world's largest economies. China's economic figures and U.S vaccination rate strengthened the sentiment. However, Traders remained wary on record breaking of new infection cases in the world's third largest user, India, that capped upswing. March Fuel consumption remained weak in India. On the supply side, OPEC+ compliance rate remained below 95% in April. Tehran is in talks with world super powers to resolve 2015 nuclear deal that may add more barrels in future , If agreement reached. On the technical side, Date Brent spreads have moved into strong backwardation, Underlining the relative tightness of the physical crude markets. Turning to weekly data, API numbers are due later today.

Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com