By Srinivas Chowdary Sunkara // petrobazaar // 29th August, 2019.

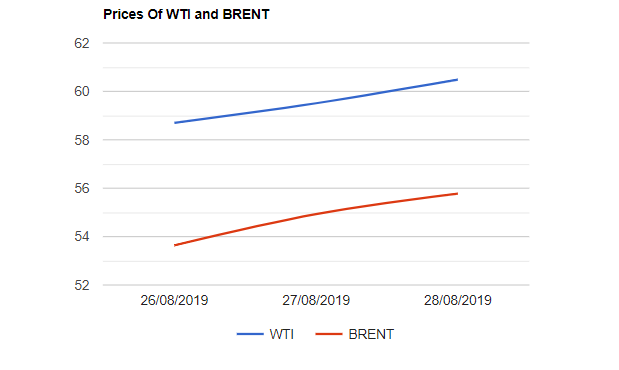

Brent for Oct settlement rose 98 cents to $60.49 and WTI futures to be delivered in Oct went 85 cents up to $55.78 a barrel last night. Shanghai crude oil main contract futures advanced 3.7 Yuan with an increase of 0.87% at 427.3 Yuan/barrel while MCX crude futures closed Rs.100 up at Rs.4010 yesterday. Brent traded at a premium of $4.71 to WTI.

The World Oil Index moved up above 1% yesterday on bullish weekly numbers from US energy department. EIA reported a steep fall of 10 Million barrels in US crude inventories where as the product inventories are decreased by 2.1 Million barrels during the week ending August 23rd. These numbers eased the fears of weakening oil demand caused by the trade war tensions. Turning to supply side news, OPEC's share of world oil markets sunk to 30%, down from more than 34% a decade ago and a peak of 35% in 2012 as a result of supply constraints and involuntary losses from Iran and Venezuela . Besides, OPEC's Joint Ministerial Monitoring Committee reported that the compliance rate of production cut pact topped at 150% and the committee said that the overall conformity of the deal helped to stabilize the market.

Asian markets opened with a gap down today and doesn't demonstrate any firm trend for today. I am in the opinion that the over all fundamental outlook is still weak and current bullish momentum is temporary. Good day.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com