By Srinivas Chowdary Sunkara // petrobazaar // 20th Oct, 2022.

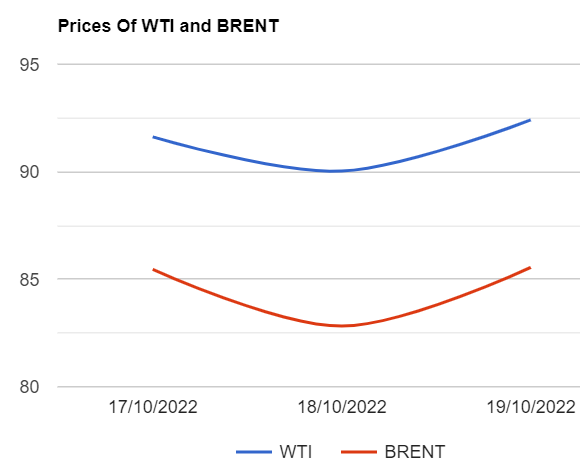

Brent oil futures for Dec delivery rose $2.38 or 2.64 pct to close at $92.41 a barrel on London based ICE futures Europe exchange while WTI oil Nov futures prices went up $2.73 or 3.3 pct to settle at $85.55 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices dipped 13.1 Yuan to 662.6 Yuan/bbl where as MCX crude oil front month futures prices spiked Rs.230 or 3.36% to Rs.7072 a barrel yesterday. Brent premium over WTI narrowed down to $6.86 a barrel during the session. U.S crude Nov futures set to expire on Thursday.

The world crude oil price index curves turned up as supply tightening signals buoyed up bullish sentiment across the market. Both the benchmarks are moving wildly in a choppy trade on erratic news. Caution over supply tightening countered prevailed bearish sentiment by gloomy economic outlook and expected opening spigots. The producer's group announcement of 2Mbpd cuts pushed oil prices up this month. EIA published that Crude oil and gasoline stocks were drawn by 3.6Mbpd and 0.1Mbpd respectively while distillates stocks were up by 0.1Mbpd during the last week. Domestic production numbers were up. Imports were decreased while exports were increased during the last week. Asian markets are opened and trading in green today.

Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com