By Srinivas Chowdary Sunkara // petrobazaar // 18th Oct 2022.

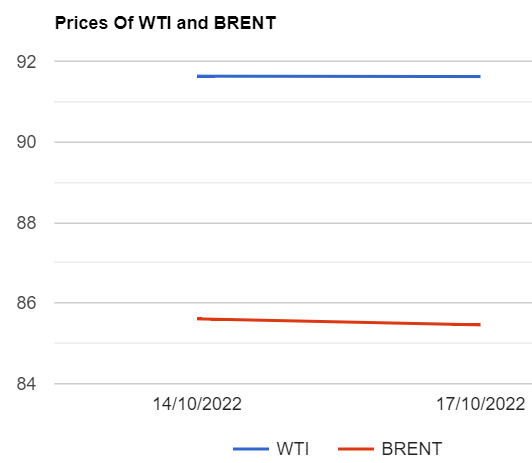

Brent oil futures for Dec delivery slipped 1 cent or 0.01 pct to close at $91.62 a barrel on London based ICE futures Europe exchange while WTI oil Nov futures prices slid 15 cents or 0.18 pct to close at $85.46 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices declined 12.9 Yuan to 671 Yuan/bbl where as MCX crude oil front month futures prices dipped Rs.8 or 0.11 pct to Rs.7064 a barrel yesterday. Brent premium over WTI widened to $6.16 a barrel during the session.

The world crude oil price index curves moved flat yesterday recovering from last week's losses. Both the benchmarks traded flat with a marginal dip of around 0.01 pct in a choppy trading amid fears of recession from gloomy economic activity across the world markets that fanned signs of demand destruction. China's continuation of loose monetary policy and OPEC+ cuts continued to extend support to oil complex. On the numbers front, U.S inflation remains the front topic with the Fed set to raise interest rates at least into next year. On the Technical side, OPEC+ more than expected cuts could attract investments into oil futures and options in the week to Oct 11th. Purchases came after OPEC+ announced its combined target of more than 2 Mpbd on Oct 5th. Hedge funds and other money managers purchased the equivalent of 47 Mb of petroleum – related futures and options. Today, Asian markets are trading in green at the time of reporting. Chinese trade and third-quarter GDP data along with Sep activity data are due to be released today. API numbers followed by EIA confirmations are awaited during the week.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com