By Srinivas Chowdary Sunkara // petrobazaar // 18th Sep, 2021.

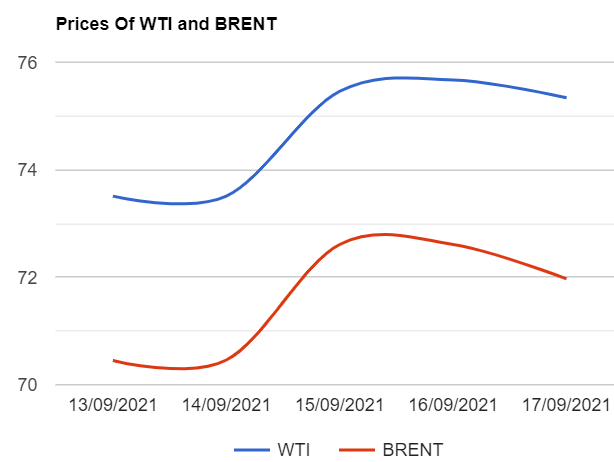

Brent oil futures prices for Nov delivery slipped 33 cents or 0.44 pct to $75.34 a barrel on London based ICE futures Europe exchange. WTI oil Oct futures dropped 64 cents or 0.88 % to settle at $71.97 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices edged up 0.9 yuan to 474.6 Yuan/bbl while MCX crude oil front month futures prices traded Rs.62 lower to close at Rs.5291 a barrel yesterday. Brent premium widened to $3.37 a barrel over WTI during the session.

The world crude oil price index curves turned down yesterday after a straight rally of four sessions in this week. Both the benchmarks posted weekly gains of around 3 pct on bullish numbers. Expected demand growth amid tightening supplies as indicated by monthly reports underpinned rally later on ripped by weekly numbers. Hurricane Ida and Nicholas disrupting Gulf of Mexico operations, Continued to buoy up prices this week. On the technical side, Money managers increased net-length in both WTI and Brent futures and options during the week ending Sep 14th. as per CFTC and ICE data. U.S drillers added another 10 rigs to 411 in U.S as per Baker Hughes weekly data. It seems markets preferred for profit taking at the end of the week that might have dented further up.

Good day and Happy week end to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com