By Srinivas Chowdary Sunkara // petrobazaar // 15th Sep, 2021.

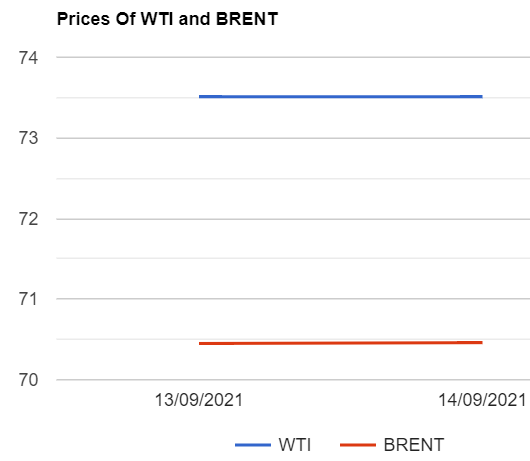

Brent oil futures for Nov delivery rose 9 cents or 0.12 pct to $73.6 a barrel on London based ICE futures Europe exchange. WTI oil Oct futures prices edged up 1 cent or 0.01 % to settle at $70.46 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures rose 4.1 Yuan to 464.1 Yuan while MCX crude oil front month futures prices closed Rs.5 higher at Rs.5184 a barrel yesterday. Brent premium over WTI widened to $3.14 a barrel during the session.

The world crude oil price index curves moved flat yesterday and closed up on expected bullish weekly numbers. The positive sentiment was buoyed up by IEA report. Turning to weekly numbers, API predicted that U.S crude oil, Gasoline and distillates stocks are drawn by 5.437 Mbpd, 2.761 Mbpd and 2.888Mbpd respectively during last week. EIA will confirm numbers later today. Consensus is on draws and expecting that EIA should be close to API this week. IEA expects rebound in global oil demand amid widening vaccine roll outs after three months of steep decline due to surge in virus cases across consuming nations. World oil supplies are expected to hold steady in Sep as unplanned outages offset OPEC+ increases as per report. On the supply side, Markets are grappled with U.S supply worries since the impact of Hurricane Ida was a lot greater than many anticipated. Tropical Storm Nicholas is set to continue disruption of operations. Though IEA report lent some support to oil complex, Chinese SPR drawings dented upside momentum. Today, Asian markets are trading in green and it does not demonstrate any firm trend so far. EIA numbers may spur some volitility.

Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com